vToken Analysis Ⅰ: Omnichain LSD & Ecosystem Applications

Web3 is making simpler for developers to create services using existing products. As a basic asset of the DeFi world, the vToken will be combined into other products allowing the growth and spread of more use-cases based on vToken features and possible applications.

This article intends to enlist these possibilities, guiding Bifrost users to the discovery of these different opportunities.

Integration of vToken in DeFi protocols

Users can utilize vToken as a reserve asset for an over-collateralized stablecoin protocol. vToken, being an interest-bearing asset, can reduce the risk of mortgage liquidation offering a better protection than a non-interest-bearing assets, hence being more suitable as a reserve asset for a stablecoin protocol than its original Token.

vToken can also serve as collateral for:

- Synthetic Asset Protocol: vToken can be deployed in relation with a wide variety of assets, even Fiat currency.

- Lending Protocol: Any form of lending in the DeFi ecosystem requires collateral due to a lack of credit data.

Since the original token and its vToken have a price correlation, the over-collateralization rate can be minimized. This gives users the opportunity to leverage off the vToken mechanism and invest the asset in the most profitable way.

ie. Staking ETH, the users can obtain the Liquid Staking Token of it which is called vETH. This can be lent, borrowed, or re-staked depending on the risk-profile of the investor and the opportunities available in the market.

Users can also set the unlocking conditions such as the time (ie. one year later), the price (sell only when the asset reach a certain price), or other external conditions that can be input through the oracle. Through the conditional lock-up agreement, vToken holders can set conditions to restrict themselves from selling, or losing the Staking income.

Splitting vToken: 2 tokens, endless possibilities

The price attribute of vToken actually can be divided in two parts:

- Cost

- Income

The vToken splits into a cost token and an income token.

Both cost and income tokens can be redeemed and traded independently, enabling complete price discovery. The cost Token maintains a 1:1 relationship with the original Token, expressing the principal redemption right. Meanwhile, the income token expresses the income redemption right and has an exchange ratio with the original token of R:1, with R increasing.

After this processing, the principal and income tokens can cater to different investors’ needs and opens up to more financial products.

If a user expects Staking income to increase, they can buy/long the corresponding income token. Conversely, if a user expects Staking income to decrease, they can sell/short the corresponding income token.

The nature of the income token is akin to traditional finance’s interest rate derivatives. One can exchange income tokens for other interest rate derivatives to achieve the effect of an interest rate swap.

If token holders believe that the staking reward is too stable and does not match their risk preference, they can exchange it for more volatile interest rate derivatives. On the other hand, if they believe that staking income fluctuates too much, they can exchange it for fixed interest rate derivatives.

In addition, whether it is the vToken itself, or the split cost Token and income Token, a series of option/futures can be deployed to provide investors with more hedging and arbitrage opportunities.

Bifrost will continue working hard in order to list vToken as a basic asset in more and more DeFi protocols. We also encourage developers of DeFi protocols to integrate vToken and offer Liquid Staking-based services featuring the Bifrost vToken.

Secondary distribution of vToken revenue: How to Play

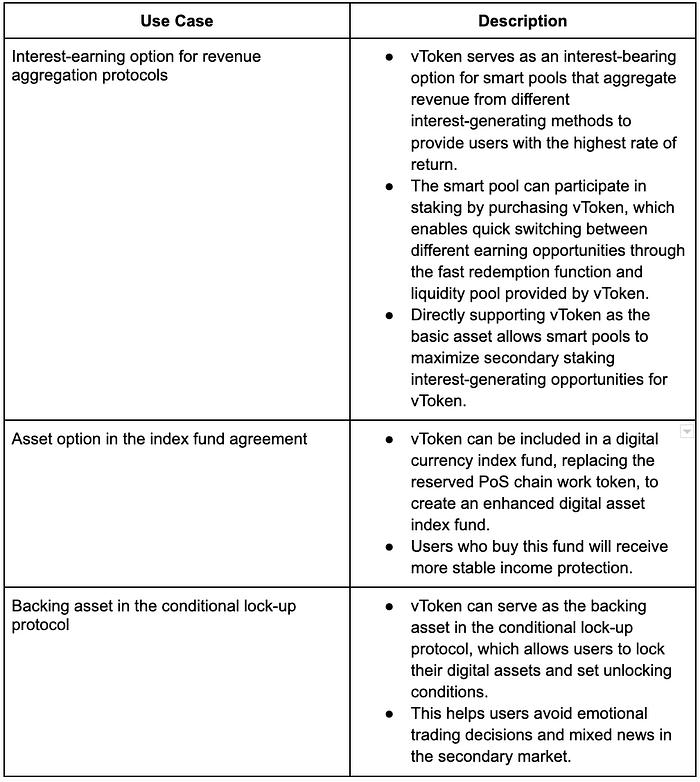

On the basis of splitting vToken, secondary distribution can also be made based on the revenue of vToken. There are several typical ways to play:

These methods apply not only to vToken, but also to other types of interest-earning assets.

Restake Strategy by EigenLayer

EigenLayer proposes its Restake Strategy, a staking method that enables the reuse of staking funds in on-chain service scenarios. This method is based on the PoS staking concept of paying a deposit and allowing the chain to confiscate it in case of improper behavior. Restake offers multiple benefits to nodes participating in the pledge and their delegators.

Eigenlayer believes that on-chain service scenarios that require quality assurance deposits can directly reuse pledged Ethereum. There are two different ways to implement Restake, as it is also mentioned within the EigenLayer Whitepaper:

(1) The application side can develop a special contract address, and the Ethereum node can entrust staking to the contract address, granting it the right to confiscate the pledge and participate in PoS staking.

(2) The application party can directly accept LSD assets as a pledge, with vToken being a suitable option.

- The second implementation option is simpler and more convenient.

- Restake is still under exploration and needs to be verified in practice.

Conclusion

The world of DeFi is rapidly developing, and the possibilities seem endless. As more projects and applications emerge, the financial tools and services available in DeFi will become increasingly abundant.

Bifrost played a fundamental part in this growth by creating vTokens, but this is just the beginning, as the protocol aims to encourage and facilitate the integration, implementation, and development of more services around vToken.

While the basic functions of vToken, such as minting, redemption, and trading, have already been established, Bifrost believes there’s more potential for vToken to offer new DeFi services.

We will explore these possibilities.

Stay tuned for the second part of our vToken Analysis, Part Two.