How LSD Projects Issue Staking Rewards

With the growth of Liquid Staking narrative, a large number of users have been exposed to this product and not everyone was immediately clear on how LSD staking rewards are issued. This has led to questions about why some LSD assets increase in number when held, and others do not. This happens because different LSD projects issue rewards in different ways.

The three methods by which rewards are issued include:

- Claim Method

- Rebase System

- Reward-bearing tokens

This article will give a specific overview of these methods.

Claim Method

In this case, LSDs are interest-bearing assets that continue to generate income. The most straightforward way for users to receive rewards is for them to claim their earnings manually. The staking income generated each time is placed in a pool, and users can manually claim it. The rewards will continue to accumulate until the user claims them.

In this case, LSD only represents the principal. The swap-rate between LSD and original assets remain 1:1. LSDs can always be redeemed for original assets at a 1:1 ratio unless a Slash occurs, which may lead to a non-anchoring.

If users need to compound the income, they must do it manually by staking and minting the LSD again. This method requires users to operate and claim frequently. Every transaction to claim or compound the interest provide gas fees. The majority of LSD protocols have abandoned this method of issuing rewards, based on these cons.

Rebase System

The Rebase mechanism is widely used for issuing LSD staking rewards.

Under the Rebase mechanism, the system will dynamically adjust the overall supply of tokens based on the generated pledge rewards or Slash: hence, the amount of LSD held by users is adjusted in proportion to the change of the overall supply.

From users perspective, they do not need to claim or compound interest manually anymore, and the amount of LSD tokens they hold keep raising. In this particular case, LSD maintains a 1:1 relationship with the original asset even if a slash occurs, because the system is able to reduce the number of LSD tokens issued to users through rebase.

Although rebase will change the balance of LSD tokens in all addresses, the rebase process does not need to spend a lot of gas. Compared with manual claiming, the rebase mechanism improves user experience and reduces overall gas consumption while issuing staking rewards.

Currently, Lido utilizes the rebase method for issuing rewards to users.

However, the rebase method has some shortcomings. When a rebase-type token is used as the primary asset in DeFi interoperability, its circulating supply change will complicate the calculation of the DeFi yield rate. If a DeFi protocol wants to integrate rebase-type tokens, it often needs unique logic to give users a real-time update display of the number of tokens. This is a considerable obstacle to the widespread integration of rebase tokens!

In addition, the rebase mechanism makes these tokens unsuitable for listing and integration on centralized exchanges. To solve this problem, Lido issued the wrapped asset wstETH, which resulted from wrapping stETH, and converted it into a reward-bearing token.

Reward-Bearing Tokens

Reward-bearing refers to the inclusion of yield and interest earned by LSD assets. This method of reward issuance breaks the 1:1 swap-rate between LSD assets and their underlying assets, allowing the rate to change in real-time as the income increases.

The reward-bearing tokens method of issuing rewards was first seen in Compound’s cToken in the DeFi field and has been adopted by most LSD protocols, including Rocket Pool, Stafi, and Bifrost.

Let’s use an example to illustrate how does it work:

At the beginning of a certain period, Alice stakes 1 ETH and get 1 vETH. Due to the income from staking, after a given time passes, her 1 vETH value is 1.05 ETH. This means that at this given time, 1 vETH can be redeemed for 1.05 ETH.

With the accumulation of staking income, the amount of ETH that one vETH can redeem continues to increase, as well as its swap-rate.

In the event of a slash, the swap-rate decreases.

Changes in the swap rate mean that both the redemption and minting rates are changing. When the current redemption rate of the protocol is that 1 vETH can redeem 1.05 ETH, only 1 vETH can be obtained by staking 1.05 ETH through the protocol.

The reward-bearing tokens model converts the staking rewards and token slashes into changes of swap-rates. With this mechanism, LSD represents the sum of the principal and the income accumulated from the beginning of staking to the current point.

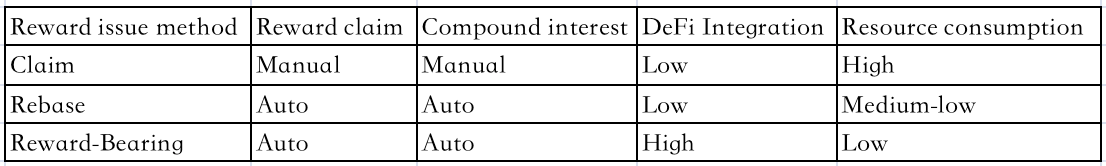

In DeFi, these LSDs are no different from other tokens so they can be easily integrated. Let’s see a comparison of these three reward-issuing methods:

A fourth alternative?

In addition to the reward issue methods listed above, some interest-bearing protocols separate the principal and income tokens. The LSD represents the principal, and the income generated is represented by a derivative asset (with a reward-bearing issuance).

At the moment LSD Protocols that rely on this method are StakeWise and FRAX. The separation of the principal and income tokens can also be achieved through third-party protocols. For example, Pendle can mint interest-earning assets into PT (Principle Token) and YT (Yield Token).

Conclusion

Bifrost, a Liquid Staking protocol launched in 2019, was one of the first LSD projects to adopt the reward-bearing tokens method for paying rewards.

Actually, due to contract limitations on Ethereum, the Claim System was used on vETH 1.0, but after the Shapella Upgrade, it has been updated to a reward-bearing mechanism.

To enhance the ease of integration of its vTokens, Bifrost carries all LSD assets in parallel chains to achieve a unified integration interface for all LSD assets, in order to lower the threshold for users and allow an easier cross-chain integration.

With Polkadot’s XCM, Bifrost can finally implement the so-called OmniLSD App, bringing LSD assets actually available in the Polkadot ecosystem cross-chain, facilitating the development of Polkadot approach to the LSDFi.